Half full Half empty

In July 2024, the economic strain on households and businesses in Nigeria intensified, exacerbated by sky-high inflation, increased interest rates, fuel scarcity, high exchange rates and other economic indices. As much as these factors are not peculiar to the month of July 2024, the impact remains significant on the livelihood of Nigerians and how much longer Nigerians can bear the burden of the hardship created by the current economic quagmire.

However, the Nigeria labor congress (NLC) and the federal government seem to have buried the hatchet upon arriving at a 140% increase in minimum wage to N70,000. This has called for a truce between the NLC and the government leading to a suspension of the NLC strikes and protests. Regardless of the increment in the minimum wage, there are still rising tensions around a proposed nationwide protest in August against the economic hardship faced by Nigerians among many other demands.

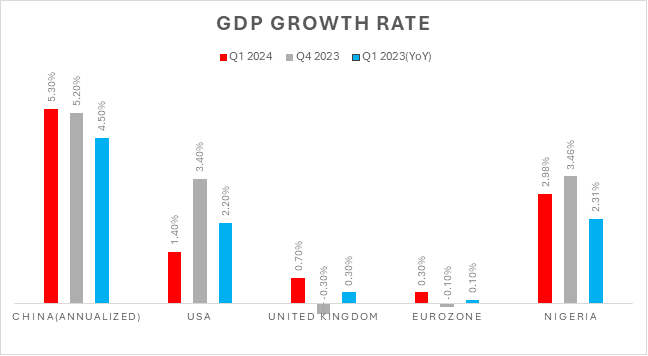

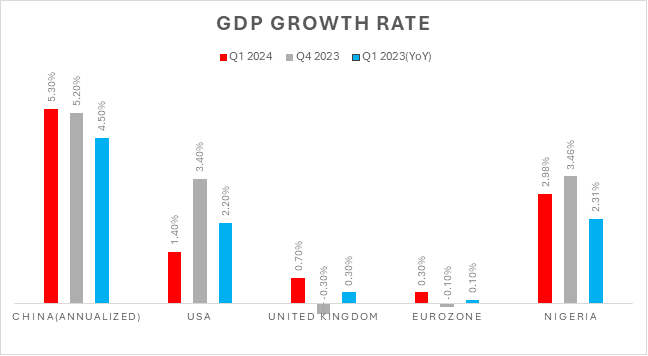

On the global scene, the United States, after a sustained period of strong outperformance, a sharper-than-expected slowdown in growth reflected moderating consumption and a negative contribution from net trade. In Japan, the negative growth surprise stemmed from temporary supply disruptions linked to the shutdown of a major automobile plant in the first quarter. In contrast, shoots of economic recovery materialized in Europe, led by an improvement in services activity. In China, resurgent domestic consumption propelled the positive upside in the first quarter, aided by what looked to be a temporary surge in exports belatedly reconnecting with last year’s rise in global demand. These developments have narrowed the output divergences somewhat across economies, as cyclical factors wane and activity becomes better aligned with its potential.

Strong Markets in China, Road to Recovery for the UK, Euro Area & US

For most part of the first half of the year contractionary monetary policies enacted by various apex banks weighed in on the economic productivity of their respective jurisdictions. In spite of this and other prevailing economic headwinds the global economy experienced an expansion.

The usual culprits China & the United States experienced a GDP Q1 growth rate of 5.30% and 1.40% respectively(Q4’23: 5.20% & 3.40% respectively). Specifically, for the US – real gross domestic product (GDP) increased at an annual rate of 1.4 percent in the first quarter of 2024, according to the “third” estimate. In the fourth quarter of 2023, real GDP increased to 3.4 percent. The increase in the first quarter primarily reflected increases in consumer spending, housing investment, business investment, and state and local government that were partly offset by a decrease in inventory investment.

China continued its run from Q4 2023 and had a strong to start to the year with a GDP growth rate of 5.30% against all odds.

The United Kingdom recorded a GDP growth rate of 0.70% in Q1 2024 a welcome upgrade from the recessionary -0.30% recorded Q4 2023 primarily driven by expansion in the services and production sector, business investments and increase in government spending. This signals an exit from the recession it experienced late last year for a slow steady GDP growth this year. It hopes to continue this trend into the second half of the year and finish strongly – This is further backed by its just concluded elections with Prime Minister Keir Starmer adamant about the success of his administration’s economic policies to turn the tide for the UK.

The Euro Area’s economy also exceeded expectations with its first quarter performance in 2024, gaining from the renewed growth in Germany and expansion in Spain. Quarter-on-quarter, gross domestic product rose by 0.3% from -0.1%, resulting in a 0.5% year-on-year increase. It is expected that growth will follow the same trajectory for H2.

Nigeria maintains a positive GDP growth rate at 2.98% for Q1 2024, albeit this was a decline from the 3.46% recorded for Q4 2023. It is important to note that YoY, the 2.98% recorded, is slightly higher than the 2.31% reported for the same quarter last year. The primary drivers of this growth are both in the oil and non-oil sectors. The services sector was the primary driver of GDP performance in Q1 2024, expanding by 4.32% and contributing 58.04% to the overall GDP. Agriculture also saw modest growth of 0.18%, an improvement from a decline of -0.90% in Q1 2023, while the industry sector grew by 2.19%, up from 0.31% in the corresponding period last year.

The services sector increased its share of the aggregate GDP in Q1 2024 compared to Q1 2023. The nominal GDP for Q1 2024 totaled N58,855,142.27 million, reflecting a 14.86% year-on-year increase from N51,242,151.21 million in Q1 2023.

High Crude Oil and Petroleum Product Inventories in OECD Countries

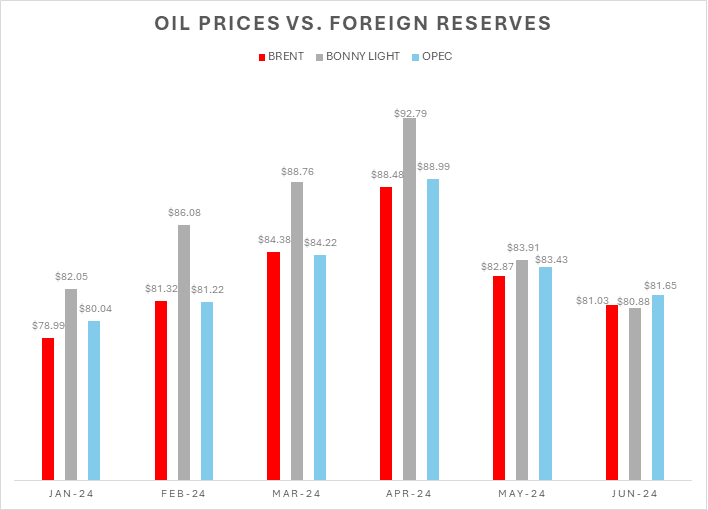

In the first half of the year, the global crude oil market was defined by fluctuations in prices facilitated by haphazard supply and demand, geopolitical tensions in the Middle East and Eastern Europe.

WTI Crude started the year priced at $72 per barrel and peaked at $87 per barrel in early April which is the highest price recorded yet for the intermediate seeing has it closed the first half of the year in the price regions of $80 to $82.

On the other hand, Brent Crude peaked at $91 per barrel in early April and slumped gradually to a low of $78 in early June but rose to close the half of the year in the price region of $84 to $85 per barrel. In the midst of high interest rates, and a tentative potential oil supply surplus, prices are expected to remain stable leading into the second half of the year. OPEC+ countries at their convening in June reached a verdict of extending most of their output cuts into 2025 while gradually easing voluntary cuts from eight member nations starting from the later part of the year. This pronouncement caused the Brent crude oil price dip experienced in early June. In spite of this, the extension of OPEC+ production cuts through the third quarter of 2024 is expected to curtail oil production for the remainder of the year, potentially driving Brent prices to average around $86(forecasted) per barrel in the second half of 2024.

Locally, Nigeria’s domestic production of crude oil averaged 1.3mbpd between January and May 2024 – The highest production was recorded in January at 1.43mbpd and lowest in March(1.23mbpd).

Nigeria’s production levels solidifies its position as one of Africa’s largest crude oil producers. Considering the oil-dependence of the Nigeria economy, volatility in oil prices and production levels affects inflows to Foreign Reserves, hence it aims to ramp up crude oil production and nip the niggling oil theft problems in the bud. The 1.25mbpd recorded in May, marks the fifth consecutive month for which Nigeria has fallen short of benchmark and production quotas mandated in its 2024 budget and OPEC’s stipulations. It is pertinent to state that the 2024 Budget was made with a benchmark oil price of $78 per barrel, which is somewhat good news, seeing that oil prices leading into H2 are above this benchmark.

Enactment of Willing Buyer – Willing Seller FX regime plummets the Naira, as it seeks its true value.

Nigeria’s foreign exchange market has had a whirlwind of a year – On the back of the unification of foreign exchange market last year, the naira depreciated by more than two-thirds of its value. Much of this depreciation was experienced in the first half of this year as the market experienced an all time high of N1900/$1 at the parallel market in late February 2024. The NAFEM market wasn’t left out either, as exchange rate on the official window plunged to N1300/$1 levels in late January and peaked at N1665.50/$1 in late February. The market was characterized by unprecedented volatility fueled by speculation and racketeering – The CBN in response swung to action and in collaboration with the Economic and Financial Crimes Commission attempted to clamp down on dollar racketeering. The Cardoso – led CBN regime also announced that it had fulfilled a key mandate of the administration by clearing ‘legitimate’ foreign exchange backlogs. Another action taken by the regime was to place regulatory sanctions on the cryptocurrency market in Nigeria – one of which is Binance, citing that Binance and crypto platforms of its kin lacked transparency and were vehicles for speculation and racketeering trades which had adverse effect on the stability of the foreign exchange markets.

The regime also decided to sell dollars to Bureau De Change Operators (BDCs) at lower rates and took other measures of selective interventions in the market, of which one could make a case that it was a Managed Float FX regime rather than a Free Float.

The first half of the year was also “Circular Season” as the CBN issued new stipulations to guide and structure its move to revamp the foreign exchange market. One of such circular was on the Net Open Position of Commercial Banks. The circular noted that banks’ Net Open Position (NOP) limit of the overall foreign currency assets and liabilities taking into cognizance both those on and off-balance sheet should not exceed 20% short or 0% long of shareholders’ funds unimpaired by losses using the gross aggregate method. Other circulars issued were related to a revised application fee for operating license for International Money Transfer Operators, IMTOs (revised from N500,000 to N10,000,000). The circular also directed that IMTOs can issue Payouts at the prevailing foreign exchange market rates with no allowable limits and restricted IMTOs to only inbound transfers with mandatory Naira payouts.

The market responded positively to these policies and the Naira appreciated marginally, albeit it was short lived as some of this policies are stop gaps and do not exactly address the FX supply issue and a miniature yet volatile foreign reserve. Nigeria’s gross external reserves saw a notable surge, reaching a new milestone in June at $34.07 billion, marking the highest level since March 2024 when it peaked at $34.2 billion — the highest in eight months. This increase follows three months of significant fluctuations, including a drop to $32.11 billion in April, which raised concerns about the country’s financial stability.

To close out the second quarter, the Naira’s erratic volatility reduced and maintained a stable range of N1400 – N1500/$1 across the NAFEM and Parallel markets. Which is a major positive against arbitrage, as the margins between official and parallel market prices are smaller – For context, the average price differential between the Parallel market and NAFEM in January 2024 was N333.82. In contrast the average price differential between the Parallel market and NAFEM for June 2024(3rd June – 21st June) was N9.82 – This figure is very similar to figures of foreign exchange markets in saner climes and allows for negligible or no arbitrage that would otherwise affect the sanctity of the FX market.

Finally, as part of this administration’s regime to stabilize the economy, the Nigerian Government seeks a $2.25 billion loan from the World Bank, which was approved in Mid-June. All things being equal, this will improve dollar liquidity and may just facilitate further Naira appreciation in the second half of the year.

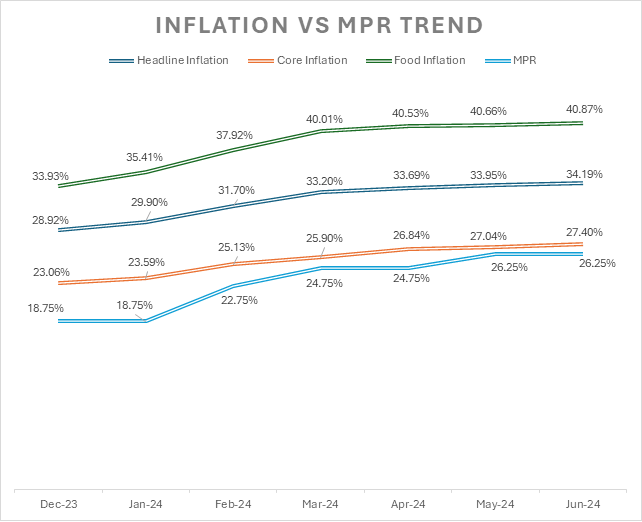

Food Inflation at all time high of 40.87% – As FMCG and other key Stakeholders lament heightened Policy rates vis-à-vis Lending rates.

The Cardoso – led CBN regime has consistently stated that one of its sole mandate is the stability of prices. In response, the regime – specifically the MPC has raised policy rates thrice in the first half of the year, resulting in an aggregate increment of 750bps(400bps, 200bps and 150bps) and MPR of 26.25%. This is understandable and is the orthodox and conventional response to Nigeria’s all time high inflationary realities. Other contractionary methods taken by the CBN is the increment of Cash Reserve Ratio and reduction of the Loan – to – Deposit ratio.

| Indices | H1 2024 | H1 2023 |

| Monetary Policy Rate – MPR | 26.25% | 18.50% |

| Asymmetric Corridor | +100/-300 bps | +100/-700 bps |

| Cash Reserve Ratio – CRR | 45% | 32.50% |

| Liquidity Ratio – LR | 30% | 30% |

| Loan-to-Deposit – LDR | 50% | 65% |

In response to these policies, Inflation hasn’t backed down to pre – 2024 levels. In January, Headline Inflation was recorded as 29.90% and spiked by 1.80% points to 31.70% – this spike was the highest recorded in H1, as Headline inflation for June was 34.19% which was a 0.24% points increase from the 33.95% Headline Inflation for May. In reality, it can be argued that on a M-o-M basis, prices are rising at a slower pace than recorded earlier in the year which may suggest that the monetary policy tightening may be having some effect even if it is not pronounced as desired.

Furthermore, NBS report indicates that while the month-on-month headline inflation rate in May 2024 was 2.14%, it showed a slight decrease from April’s 2.29%, suggesting a slower pace of price increases compared to the previous month. Key contributors to headline inflation in May 2024 included Food & Non-Alcoholic Beverages (contributing 17.59%), Housing, Water, Electricity, Gas & Other Fuel (contributing 5.68%), and Clothing & Footwear (contributing 2.60%). Food inflation in Nigeria reached 40.87% in June 2024, a significant rise(a 62% increase) from the 25.25% recorded in June 2023 and higher than the 40.66% recorded in May 2024. Core inflation(excludes the volatile agricultural produce & energy prices) rose to 27.40% in June 2024, up from 27.04% in May 2024.

On a global scale, inflation is projected to decline steadily, with advanced economies achieving their inflation targets earlier than emerging markets and developing economies. The downward trend is expected to continue throughout 2024, supported by contractionary monetary policies dampening. Forecasts for Q2 2024 anticipate global consumer price inflation easing to 6.4% and further dropping to 3.7% in 2025. Excluding Argentina, where hyperinflation is anticipated. In the United States, consumer prices remained stable in May, with lower gasoline and other goods prices offsetting higher rental housing costs. However, inflation remains elevated, delaying potential interest rate cuts by the Federal Reserve until at least September. In the UK, inflation fell to the Bank of England’s target of 2.0% in May 2024, down from 2.3% in the 12 months to April. On a monthly basis, CPI rose by 0.3% in May 2024, compared with a rise of 0.7% in May 2023. Conversely, the Euro Area saw an annual inflation rate of 2.6% in May 2024, up from 2.4% in April, contrasting with 6.1% a year earlier. Similarly, the European Union’s annual inflation rose to 2.7% in May 2024 from 2.6% in April, compared to 7.1% a year on year.

There is cautious optimism for the second half of the year and beyond in terms of stable prices due to geopolitical tensions, elections and the requisite regime change or continuity that comes with the electoral processes – Overall there are pronounced growth prospects and all things being equal an outlook for stable prices in H2 2024 and beyond.

Bullish Nigerian Stock in the Equities Markets in Q1, Average Bond Yield Increases in response to Hiked Monetary Policy Rate and High Inflation.

Notwithstanding the economic travails, the Nigerian Stock Market was influenced immensely by bullish sentiments in Q1 2024 as the NGX AllShare index(ASI) and market capitalization rose by 39.47% and 44.10% to close at 104,283.64 and N58.96 trillion respectively driven by strong refreshed interest in low cap stocks, new listed stock, and expectation of dividend payments. The total number of transaction on the stock exchange increased voluminously from N0.53 trillion in Q1 2023 to N1.55 trillion in Q1 2024 (a 192.45% increase). The pivot to a free float exchange rate system has helped improve foreign portfolio investors(FPI) sentiments evidenced by transaction of foreign portfolio investors increasing by 297% to N213.18 billion in Q1 2024, from N53.71 billion reported in Q1-2023. The ASEM index gained by 135% crowning it as the best performing index in Q1 2024.

In Q2 2024, the NGX depreciated by 4.3% facilitated by banking stocks losing almost a fifth of their value. The second half of the year is expected to be dominated by capital raises, as banks and other key players in the sector seek to recapitalize to meet regulatory requirements, expansion plans and enhance a strong capital base – These raises will likely have a dilutive effect on the existing shares in the market. It is anyone’s guess whether this bearish trend in the NGX will persist.

Meanwhile, in the Nigerian fixed-income market, money market instruments ((1year T-bills) and mid-tenured government bonds (9-year FGN bonds) rose by 1228bps and 550bps respectively between January and June 2024. Despite interest rates currently reaching historical highs, aligning with the strategic initiatives pursued by both the Debt Management Office (DMO) and the Central Bank of Nigeria (CBN) in 2024 to combat rising inflation, it is believed that rates have reached their peak and may start to dip marginally, aiming to alleviate the federal government’s borrowing costs.

Stronger & Healthier Banks needed for $1 trillion economy grand plan.

On 28th March 2024 the Central Bank of Nigeria issued a circular titled “REVIEW OF MINIMUM CAPITAL REQUIREMENTS FOR COMMERCIAL, MERCHANT, AND NON-INTEREST BANKS IN NIGERIA” – Essentially, the apex bank mandated that all Commercial, Merchant and Non-Interest Banks recapitalized and must meet the required minimum capital requirement within a period of 24 months, commencing from April 1, 2024 and ending on March 31, 2026. The Banking Sector Recapitalization Programme 2024 as it is called is a necessity according the CBN to facilitate for stronger and resilient banks against external and domestic shocks as well as enhance the stability of the financial system. The CBN aims to ensure Nigerian banks have a robust capital base to absorb unexpected losses and capacity to contribute to the growth and development of the Nigerian economy.

Some industry players believe that the programme was initiated to create bigger banks with stronger capital bases that can support both the government (public sector) and the private sectors reducing the chances of a crowding out effect in the years to come. The last recapitalization process took place in 2004 within an 18 months period (from N2bn to N25bn).

| Bank Type | Authorization Type | Previous Minimum Capital Requirement (N’billion) | New Minimum Capital Requirement (N’billion) |

| Commercial | International | 50 | 500 |

| National | 25 | 200 | |

| Regional | 10 | 50 | |

| Merchant | National | 15 | 50 |

| Non – Interest | National | 10 | 20 |

| Regional | 5 | 10 |

The CBN’s circular recognizes three options for banks seeking to comply with the new order: fresh equity, mergers and acquisitions (M&A), and a change in license authorization (downward or perhaps upwards). Consequently, some of Nigeria’s banks with international authorization have begun their recapitalization process – In the final weeks of H1, Fidelity Bank PLC embarked on its Right Issue and Public Offer programme. Access Corporation (via a Rights issue) and GTCO (via a public offer) will follow suit in early H2(July – August). Consequently, all commercial banks across the three authorization types would need to raise a total of N4 trillion to meet the CBN’s new regulatory requirement.

Global Economy

On a global scale, economic growth is expected continue its recovering positive trend through the second half of the year – albeit the growth will be at a sluggish rate and dependent on geopolitical tensions, electoral outcomes, quantitative easing or tightened monetary policies in various countries weighing on the global economic output.

Taking into cognizance the ongoing inflation – targeting efforts of the apex banks of most markets in advanced and emerging countries, we do not expect aggressive quantitative easing measures nor monetary policy tightening in the second half of the year – However, the Federal Reserve is forecasted to apply rate cuts starting mid – H2. Globally, oil production will remain steady or even slow down due to decisions made at the convening of OPEC+ members in June to extend voluntary oil production cuts through the third quarter of the year. This in tandem with tensions in the Middle East and Eastern Europe may result in elevated prices of crude oil.

Nigeria

We expect dilution in the shares of Nigerian banks on the stock exchange as more banks look to recapitalize via rights issues or public offers. This also means heightened transactions on the NGX.

We expect a sluggish GDP growth rate from the 2.98% recorded in Q1 2024 – projecting that GDP growth rate will close the year between (3.00% – 3.18% forecasted). We also anticipate marginal decline in headline inflation from mid-H2 in response to contractionary monetary policies and expect the CBN to at the very least keep policy rate steady in the early part of the second half of the year and hike the rates further if inflation ceases to respond to said policies.

In the foreign exchange market, it is imperative for the central bank to ensure transparency in forex management, enhance efforts to boost forex inflows, and maintain exchange rate stability. We anticipate less volatility than experienced in H1 and expect the Naira to remain stable within the N1400 – N1500/$1 range and even appreciate below this range if the fiscal plans seeking dollar funding are consummated successfully. A fully operational Dangote Refinery may also help improve dollar inflows.

We anticipate that rates/yields in the bonds and treasury bills market will remain elevated through the second half of the year owed to the heightened policy rates, which should attract more foreign portfolio and local investors.

Overall, our response to the current economic realities is one of cautious optimism, we believe it is a long, hard road to optimal levels, but we are on the right track and are utilizing sane, orthodox and conventional economic fundamentals to achieve this. Half Full.