The Role of SMEs in Economic Growth

Small but Mighty!

Lao TzuAn ant on the move does more than a dozing ox.

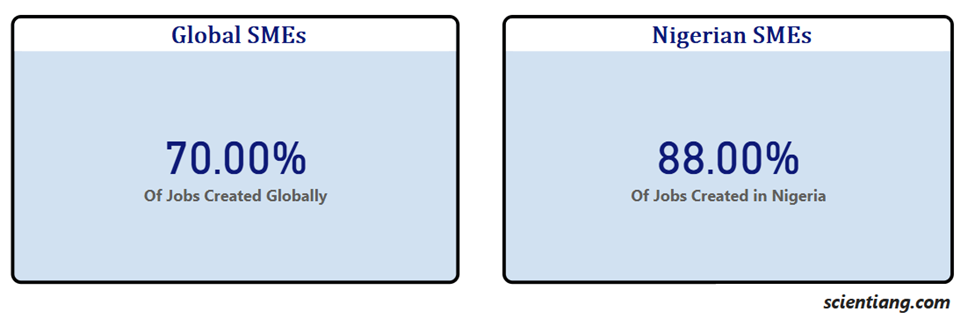

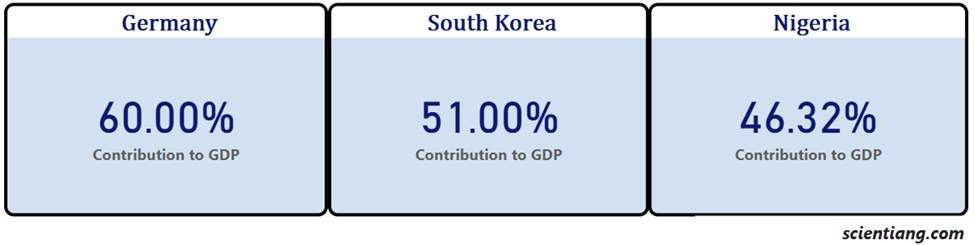

When an economy is stripped to its essentials, removing the towering skyscrapers of multinationals, deep pockets of oil conglomerates, and the most prominent stock market players, you will find instead the heartbeat and gold mine of commerce, Small and Medium Enterprises (SMEs). Globally, these businesses account for more than 70% of all businesses. In Nigeria, that number is 96%, contributing about 46.32% to the nation’s GDP and providing jobs for over 87.9% of the workforce (PWC, 2024). It means that about 9 of every 10 jobs in the country exist because an entrepreneur dared to start a business; from bustling markets to high-tech startups, SMEs don’t just support the economy; they are the economy.

However, their role goes beyond numbers and statistics. Every large corporation today started as a small business, so it’s not surprising that SMEs drive local production, foster innovation, and help build economic resilience. Strategic support for SMEs has translated into a global industrial and technological revolution, as seen in the case of developed countries like Germany and South Korea. South Korea reportedly built its $1.72 trillion economy on the backs of SMEs, and Germany’s “Mittelstand” (mid-sized firms) is known for exporting world-class engineering to every corner of the globe. This proves that small businesses are not just vital but, if supported, have the potential to be transformational, and if history has taught us anything, it is that nations don’t rise from the wealth of a few but from the strength of the masses.

A tiny drop!

“A small business may seem like a drop in the ocean, but enough drops—and the tide begins to turn.”

Beyond the numbers, SMEs help create diverse and decentralized employment opportunities. Unlike large corporations usually focused on urban centers, SMEs help spread economic opportunities across rural and semi-urban areas by supporting local communities. An example is Vietnam, where targeted SME policies enabled small manufacturers and agribusinesses to scale and shape the economy. Ultimately, they helped reduce the unemployment rate from 6.4% in 2000 to below 2% by 2023.

Another important point to note is that every significant technological shift, from the industrial revolution to the digital era, has been shaped by small businesses daring to offer novel solutions. There are numerous examples; Amazon started as a small online bookstore, and Samsung was a trading business before evolving into a tech giant. SMEs increase innovative products and services in the market, adapting quickly to consumer needs, experimenting with new technologies, and driving industry-wide advancements. Even in Nigeria, startups like PiggyVest, Flutterwave, and Paystack have helped improve finance across Africa, reflecting SMEs as catalysts for economic growth.

SMEs reduce sole dependence on large corporations, which improves overall economic stability. During the 2008 global financial crisis, countries with strong SME sectors rebounded faster because small businesses were more adaptable and distributed across various industries. A thriving SME sector, especially in non-oil industries like agribusiness, technology, and manufacturing, is essential to creating a balanced and diversified economy.

While the narrative around entrepreneurship in Nigeria is often wrapped in optimism and energy, the reality on the ground tells a more sobering story. Beneath the surface of innovation hubs, pitch competitions, and social media success stories lies a harsh truth—over 80% of Nigerian small businesses are unable to survive beyond their first five years. This staggering failure rate reflects a deeply challenging operating environment, where structural barriers, limited access to finance, poor infrastructure, and inconsistent policy support combine to make business survival more of a struggle than a success story.

Too Many Too Little

At the start of the year, The Economist stirred the pot with a report claiming that Africa had too many small businesses. At first glance, that seems counterintuitive—aren’t small businesses supposed to be the backbone of any thriving economy? Well, yes… and no.

Small businesses are great for kickstarting local economies. They keep communities active, create jobs, and introduce all kinds of hustle into the market. But here’s the thing: they’re meant to be a stepping stone, not the final destination. The real value of small businesses isn’t just in starting up—it’s in scaling up. Over time, we should be seeing many of these SMEs grow into mid-sized and large enterprises that generate more jobs, contribute more taxes, and have real staying power in the market. That growth is not happening nearly enough. The reason is simple: the environment that should help small businesses scale isn’t fully built out.

Access to affordable credit is patchy, business support systems are inconsistent, and infrastructure is still playing catch-up. And consumers? Their purchasing power often can’t keep up. It’s not just about having more entrepreneurs—it’s about creating the conditions for those entrepreneurs to build something lasting. That’s where policymakers come in. Intentional policies around access to finance, credit, market linkages, and even education can help move the needle. But it’s also about the people. A community with stronger purchasing power can sustain more business growth. And stronger SMEs, in turn, can uplift that same community—creating a cycle that pushes the entire economy forward. The bottom line? Small businesses aren’t the problem. But staying small forever might be.

Let the SMEs breathe!

We talk a lot about SMEs being “the backbone of the economy,” but let’s be honest—right now, that backbone is carrying way too much weight with very little support. While it is easy to celebrate SMEs, most were born out of necessity and a lack of mainstream opportunities. If we truly want to feel the impact of SMEs and stop more than 80% that collapse in five years from doing so, there is a need for more action. So, how do we go from struggling hustle to sustainable scale?

1. Fix Credit Access—But Don’t Stop There

Yes, affordable credit is important. But credit without structure is chaos. Nigeria needs to improve its consumer credit infrastructure, digitize risk assessment through BVN/NIN integration, and incentivize long-term lending with tax breaks or guarantees for banks’ lending to SMEs in critical sectors. The goal isn’t just to throw money around—it’s to lend in a way that gives small businesses breathing room without strangling them in debt.

2. Build Capacity, Not Just Hope

A lot of SMEs fail not because they don’t try hard enough, but because they’re stuck running in place. There is a need to invest in founder education (basic finance, customer segmentation, digital marketing), encourage localized business incubators and accelerators that understand market realities. When businesses learn together, they grow together.

3. Make Policy Consistent & Market-Friendly

The Nigerian business environment shouldn’t feel like a game of “surprise!” every other quarter. The government has a responsibility to simplify tax codes and registration while creating policies that reward trustworthy SMEs with better financing terms.

4. Leverage Technology to Bridge Gaps

Whether it’s logistics, finance, inventory, or marketing, tech can cut through Nigeria’s friction. There is a need to promote and support digital infrastructure, especially in rural areas that support financial transactions.

SMEs don’t need magic. They just need room to breathe, tools to grow, and customers with the means to support them. When you get those three things right, everything else becomes easier.